Understanding How Your Earnings Change Throughout Your Career: Insights from EverFi Salary Data

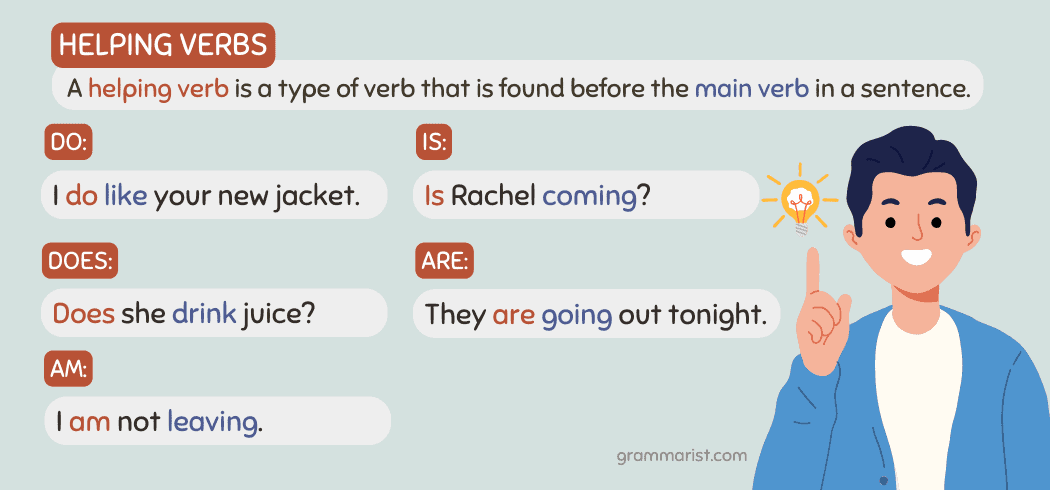

How Earnings Typically Change Over the Course of a Career

Your earnings are likely to change significantly as you progress through various stages of your career. This growth is influenced by factors such as experience, education, industry, job performance, and the choices you make at key transitions. Understanding these patterns can help you plan strategically for long-term financial stability and professional satisfaction.

Early Career: Entry-Level Roles and Initial Earnings

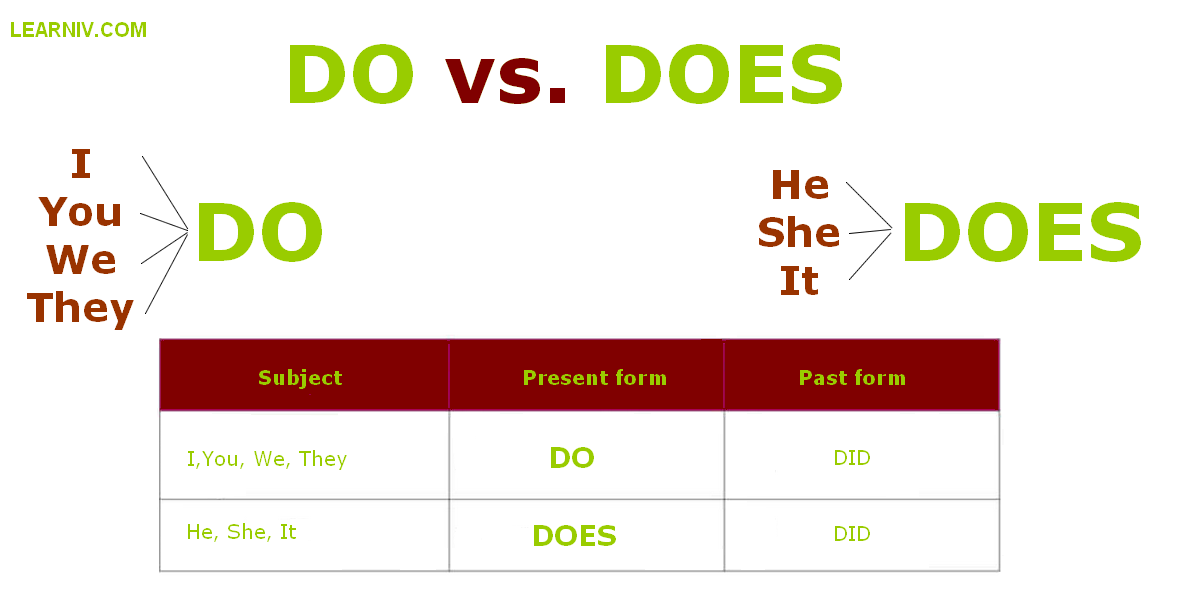

In the first years after entering the workforce, most professionals begin in entry-level positions. For example, at EverFi, roles such as Admin Assistant or Business Development Representative typically earn between $46,000 and $48,000 per year, according to reported salary data [1] [5] . These starting salaries reflect limited experience and are common across many industries. During this stage, it is crucial to focus on skill-building, networking, and demonstrating reliability to set the foundation for future advancement.

Practical guidance for this stage includes:

- Seeking mentorship from experienced colleagues.

- Participating in professional development or training programs.

- Actively soliciting feedback to improve job performance.

Many organizations, including EverFi, offer internal resources for professional development. To access these, you can consult your company’s human resources department or search for professional training programs in your field using reputable job boards or career resource platforms.

Mid-Career: Growth Through Experience and Responsibility

As you gain experience-typically 5-15 years into your career-earnings often rise as you move into roles with greater responsibility. At EverFi, mid-level positions such as Project Manager or roles in Education & Instruction can pay between $57,000 and $132,000 annually based on reported data [5] . Salaries in departments like IT and HR at EverFi average around $94,344 to $148,368 per year [1] .

Source: mimundomanualyartistico.blogspot.com

This stage is marked by:

- Pursuing advanced certifications or degrees to expand your expertise.

- Taking on leadership or management roles.

- Negotiating compensation packages as your value increases.

For those seeking advancement, you can request performance reviews, set clear career goals with your manager, and explore open positions within your company. If you are looking outside your current employer, use verified job search sites such as Indeed, LinkedIn, or Glassdoor for opportunities and salary comparisons.

Senior-Level and Executive Roles: Maximizing Lifetime Earnings

Professionals who reach senior or executive levels typically see the highest earnings in their careers. At EverFi, senior management and executive positions such as Vice President of Product or General Counsel can earn between $179,000 and $231,517 per year [1] [5] . These roles come with increased responsibility, strategic decision-making, and often oversee large teams or departments.

To reach this level, you may need to:

- Develop a track record of successful projects and leadership.

- Continue education through executive training or MBA programs.

- Build a strong professional network by joining industry associations or attending conferences.

Many senior professionals also consider consulting, board positions, or entrepreneurship as avenues to further increase income and influence.

Factors That Influence Earnings at Every Stage

Your earnings trajectory is shaped by a combination of personal and external factors. Key influences include:

- Education: Higher degrees often open doors to better-paying positions, but the return on investment varies by field and employer.

- Industry and Location: Some industries and geographic areas offer higher average salaries due to demand and cost of living.

- Performance and Skills: Consistently high performance and in-demand skills can accelerate raises and promotions.

- Company Policies: Each employer’s compensation structure, benefits, and promotion practices can impact how quickly you advance.

For a real-world example, EverFi’s average annual salary as of August 2025 is reported as $94,489, with hourly rates around $45 [2] [3] . Salary ranges can be wide depending on role, department, and location, so it is important to research typical compensation for your target position and negotiate accordingly.

How to Access Better Earnings Opportunities

If you are looking to increase your earnings over your career, consider these actionable steps:

Source: ssissimon.blogspot.com

- Regularly update your resume and professional profiles with new skills and achievements.

- Seek internal promotions or lateral moves that offer learning opportunities and better pay.

- Research your field’s salary trends using reputable career resources and salary comparison tools.

- Consider further education or certifications that are highly valued by employers in your industry.

- Network with professionals inside and outside your organization to learn about new opportunities.

When exploring new job opportunities, you can use platforms like Indeed, LinkedIn, or Glassdoor to compare salaries and identify employers with competitive compensation packages. For internal opportunities, speak with your HR representative or manager about available career development resources.

Challenges and Solutions in Career Earnings Growth

Many professionals encounter obstacles such as limited advancement opportunities, lack of access to training, or stagnant wages. If you experience these, consider the following solutions:

- Request feedback and a clear path for advancement from your supervisor.

- Participate in free or low-cost online courses to add in-demand skills to your portfolio.

- Connect with local or national professional associations for networking and mentorship.

- If your current employer does not offer growth opportunities, consider seeking positions at organizations known for promoting from within.

For those in specialized fields or with unique skill sets, it may be beneficial to consult industry-specific career websites or speak with a recruiter who understands your market.

Alternative Approaches to Maximizing Earnings

If traditional employment paths are not meeting your financial goals, alternatives include:

- Pursuing freelance or contract work to diversify income streams.

- Starting a side business or consulting practice in your area of expertise.

- Exploring remote or international job opportunities where your skills are in higher demand.

Each approach has its own risks and rewards, so evaluate your personal circumstances and financial needs before making a transition.

Summary: Planning for Long-Term Earnings Growth

Your earnings typically increase as you gain experience, take on more responsibility, and demonstrate your value in the workplace. Data from EverFi and similar organizations illustrate the wide range of salaries available at different stages and job functions. By focusing on professional development, proactive career management, and informed decision-making, you can maximize your earnings over the course of your career.

For further information about salary trends and career planning, you can search for terms like “career salary growth”, “average salary by industry”, or “professional development resources” on major job boards and career sites. Consult your HR department or career counselor for personalized guidance.