Mastering Your Business Pitch: Purpose, Essentials, and What to Leave Out

Introduction

In today’s competitive marketplace, the ability to deliver a concise and persuasive business pitch can determine whether your idea secures funding, forms critical partnerships, or simply gets noticed. Yet, many entrepreneurs and professionals misunderstand both the main purpose of a business pitch and which points are most important to include. In this comprehensive guide, you’ll learn how to focus your pitch for maximum impact and recognize which details may be best left out for clarity and effectiveness.

The Main Purpose of Developing a Business Pitch

The primary purpose of developing a business pitch is to effectively communicate your business idea and its value to a targeted audience-usually investors, potential partners, or customers-so that they are compelled to take a specific action. This action might include providing funding, entering into a strategic partnership, or deciding to purchase your product or service. A business pitch is not merely an informational presentation; it is a strategic tool designed to persuade and inspire confidence in your proposition [1] [2] [3] .

Key objectives of a strong business pitch include:

- Capturing interest : Your audience’s attention is the first hurdle; a compelling pitch quickly communicates why your idea matters.

- Building trust : Demonstrating expertise, preparation, and understanding of the problem and solution builds credibility.

- Highlighting unique value : Clearly stating what differentiates your idea from competitors is essential for standing out.

- Prompting action : The pitch should end with a clear call-to-action tailored to your audience’s potential role (investment, partnership, purchase).

For example, a tech startup seeking venture capital might focus on how their solution addresses a critical market gap and showcase early traction or industry validation. Their pitch will be tailored to emphasize growth potential and scalability, which are points of interest for investors.

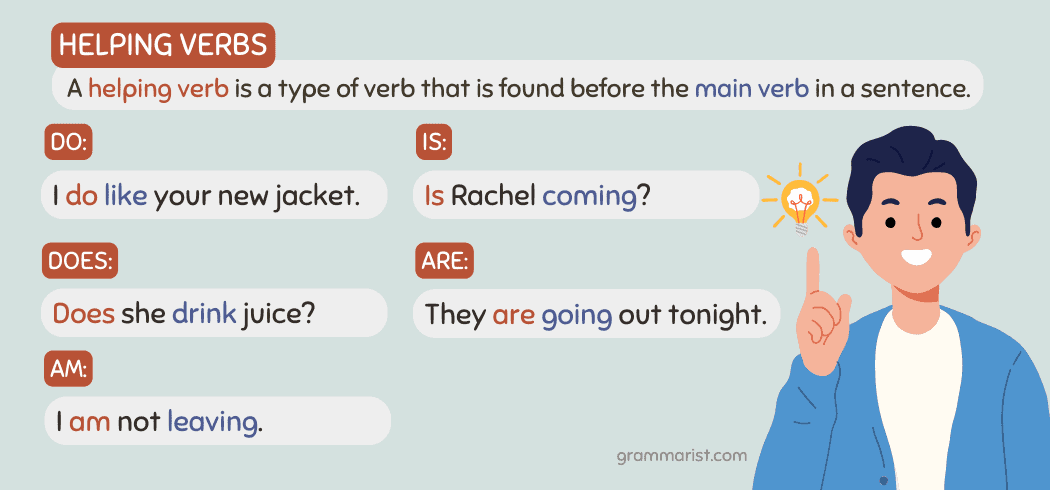

Core Elements to Include in a Business Pitch

An effective business pitch typically includes several critical components. Each serves a distinct purpose and should be tailored to the audience and context of the pitch:

Source: frigorifix.com

- Problem Statement : Clearly define the problem or need your business addresses. This shows you understand your market and establishes relevance [3] .

- Solution : Articulate your unique approach or product and how it solves the identified problem.

- Market Opportunity : Provide data or analysis that demonstrates the size and value of the market you’re targeting. This reassures investors and partners of growth potential.

- Business Model : Explain how your company will generate revenue and become sustainable.

- Competitive Advantage : Highlight what sets your solution apart-whether it’s technology, experience, intellectual property, or a unique approach.

- Traction : If available, share evidence of progress such as customers, revenue, partnerships, or pilot results.

- Team : Introduce key team members and their qualifications to build trust and credibility.

- Call-to-Action : Clearly state what you want from your audience-investment, partnership, a meeting, or another specific next step.

For instance, if pitching to a corporate partner rather than an investor, you might place greater emphasis on potential synergies, shared goals, and integration points, rather than on financial projections.

Which Points Are

Not

Important to Include in a Business Pitch?

While it’s tempting to share every detail about your business, certain points are probably not important to include, especially in a first pitch or when time is limited. Including unnecessary information can dilute your main message and weaken your persuasive impact. Here are some details often best omitted or minimized:

- Personal Biographies Unrelated to the Business : Unless your or your team’s background directly supports your business’s credibility or execution potential, lengthy personal stories or unrelated achievements can distract from the core business proposition.

- Excessive Technical Jargon : Deep technical details are usually unnecessary unless your audience is highly technical. Focus on the benefits and outcomes rather than granular specifications.

- Unverified or Speculative Claims : Avoid making unsupported predictions or referencing future products/services that are speculative. Investors and partners look for grounded, credible presentations.

- Minor Operational Details : Day-to-day operational tasks, internal processes, or administrative minutiae rarely impact the audience’s decision and can be discussed later if interest is shown.

- Irrelevant Historical Data : Past business ventures or long company histories that don’t inform your current value proposition are usually not relevant at the pitch stage.

For example, if you’re pitching a new SaaS product to investors, a deep dive into your early logo design process or office setup is unlikely to influence their decision and may signal that you’re not focused on what matters most.

How to Structure and Deliver an Effective Business Pitch

Crafting and delivering a pitch requires more than just following a template. Here are actionable steps and alternatives for making your pitch stand out:

- Research Your Audience : Understand what matters to them. Investors care about returns and risk; customers care about value and ease of use; partners want strategic fit.

- Start with a Hook : Open with a compelling fact, question, or story that immediately relates to the problem you solve.

- Keep It Concise : Respect your audience’s time by focusing on high-impact points. Aim for clarity over quantity.

- Use Visual Aids : If presenting slides, use visuals to simplify data and keep attention focused.

- Practice and Refine : Rehearse your pitch and seek feedback. Adjust based on audience reactions and questions.

- Prepare for Q&A : Anticipate likely questions and have succinct, honest answers ready.

Alternative approaches include developing both a short “elevator pitch” (30-60 seconds) for informal encounters and a more detailed pitch deck for formal meetings. In both cases, the focus should remain on the value you deliver and the action you want your audience to take.

Step-by-Step Guidance for Accessing Pitch Opportunities

Accessing pitching opportunities varies by industry and stage, but here are general steps you can follow:

- Identify relevant pitch events, startup accelerators, or business competitions in your region or sector. Local chambers of commerce, business incubators, and industry groups often host such events.

- Research investor networks or professional associations related to your field. Many have application portals or event calendars open to new pitches.

- Prepare both a short verbal pitch and a supporting pitch deck. Resources and templates are widely available from reputable entrepreneurship organizations such as SCORE or the U.S. Small Business Administration (SBA). To find these, visit the official SCORE or SBA website and search for “business pitch template.”

- Consider reaching out to business mentors or entrepreneurial support networks for feedback and introductions. Many organizations, including local economic development agencies, offer mentoring and pitch preparation workshops.

- Be persistent. Not every pitch will result in immediate success, but each opportunity is a chance to refine your message and expand your network.

If you are seeking to connect with investors, you can search for “angel investor networks” or “venture capital firms” alongside your industry and location. Always review their submission guidelines to ensure your pitch aligns with their focus areas.

Potential Challenges and Practical Solutions

Pitching can present several hurdles, including stage fright, unclear messaging, or lack of traction. Here are common challenges and actionable solutions:

Source: frigorifix.com

- Nervousness or Inexperience: Practice repeatedly and seek feedback from trusted colleagues or mentors. Participating in pitch workshops or joining public speaking groups can build confidence.

- Overloading Information: Focus on the most compelling facts and eliminate non-essential details. Ask yourself, “Does this point move my audience closer to a decision?”

- Lack of Traction: If you’re pre-revenue or pre-launch, emphasize your team’s strengths, the market need, and any validation (interest from customers, pilots, letters of intent) you have.

- Technical Complexity: Use analogies and simple language to explain sophisticated concepts. Tailor your depth of detail to your audience’s background.

Summary and Key Takeaways

Developing a business pitch is about more than presenting facts-it’s about telling a persuasive, focused story that moves your audience to act. By understanding the main purpose of a business pitch and focusing on essential elements while leaving out non-essential details, you vastly improve your chances of success. Use available resources, seek feedback, and continually refine your approach to master the art of pitching.