Optimizing Your Business Essentials: Credit Cards, Print Materials, and Delivery Timelines

Introduction

Running a successful business involves making strategic decisions about finance, branding, and logistics. Whether you’re deciding how many business credit cards to hold, how many business cards to order for networking, or how to plan around ‘1-2 business days’ delivery timelines, each choice has a direct impact on your company’s efficiency and professionalism. This article provides in-depth guidance on these three essential operational elements-empowering you to make decisions that support your company’s growth and reputation.

How Many Business Credit Cards Should You Have?

Business credit cards are vital tools for separating company and personal expenses, building credit, and accessing rewards or financing. However, the number of cards you should have is not one-size-fits-all. Instead, it depends on your business’s size, spending habits, and management capabilities.

Key Considerations

According to financial experts, most small-business owners benefit from having at least one business credit card to establish credit and streamline expense tracking. For many, two to three cards -each serving a specific purpose-can optimize rewards and provide backup if a card is lost or compromised [1] [2] [3] . For example:

- One card dedicated to general operating costs

- One card that maximizes travel or cash-back rewards

- An additional card for department-specific or employee spending (for larger teams)

There is no fixed maximum , but it’s crucial not to take on more cards than you can responsibly manage. Overextending can result in missed payments, fees, or negative credit impacts. Each card should serve a clear, strategic business need [1] .

Real-World Example

A growing consultancy started with one business credit card. As team roles expanded, they added a second card with better travel rewards for sales staff and a third for dedicated office expenses. This approach helped them maximize rewards without losing track of payments.

Source: taxuni.com

Step-by-Step Guidance for Choosing the Right Number

- Assess your monthly business expenses and identify spending categories (e.g., travel, office supplies).

- Research cards that offer the best rewards or benefits for those categories. Many comparison tools are available from reputable financial news sites and banks.

- Start with one card and monitor how well it meets your needs. Add additional cards only if they help you achieve specific business goals or simplify accounting.

- Ensure you have the capacity to track all payment due dates and manage balances to avoid interest and fees.

Alternatives and Additional Tips

If multiple employees need to make purchases, some providers allow you to issue employee cards on a single business account, which simplifies management. Alternatively, business expense management platforms can centralize tracking. Always review annual fees and ensure the rewards you earn offset those costs.

How Many Business Cards Should You Order?

Business cards remain a powerful networking and branding tool, despite digital alternatives. Deciding how many to order depends on your networking habits, company size, and upcoming events.

Key Factors to Consider

- Frequency of events : If you attend conferences or trade shows regularly, you’ll need a higher supply.

- Team size : Order cards for each employee who interacts with clients or partners.

- Design changes : If your business details or branding are likely to change soon, avoid over-ordering to prevent waste.

Typical Order Quantities

Standard print runs for business cards start at 250 to 500 cards per person , which is sufficient for most new employees or annual needs. For established professionals with high networking volume, ordering 1,000 cards may be practical. If you’re unsure, start small and reorder as needed; many online print services allow for quick, low-minimum reorders.

Real-World Example

A tech startup with a team of five ordered 500 cards per employee before a major industry conference. Post-event, they evaluated usage and adjusted quantities for future print runs, saving money and reducing unused inventory.

Step-by-Step Ordering Guidance

- Estimate how many cards you hand out at an average event and multiply by your annual event attendance.

- Include extras for unplanned opportunities and daily encounters.

- If you anticipate rebranding, select a lower quantity and consider digital alternatives as a temporary solution.

- Choose a reputable print provider-major office supply chains and specialized online printers are popular options. Search for recent reviews to confirm quality and turnaround times.

Alternatives and Best Practices

Consider supplementing physical cards with digital business card apps, especially if your industry values tech-forward solutions. Always proofread thoroughly before ordering to avoid costly reprints.

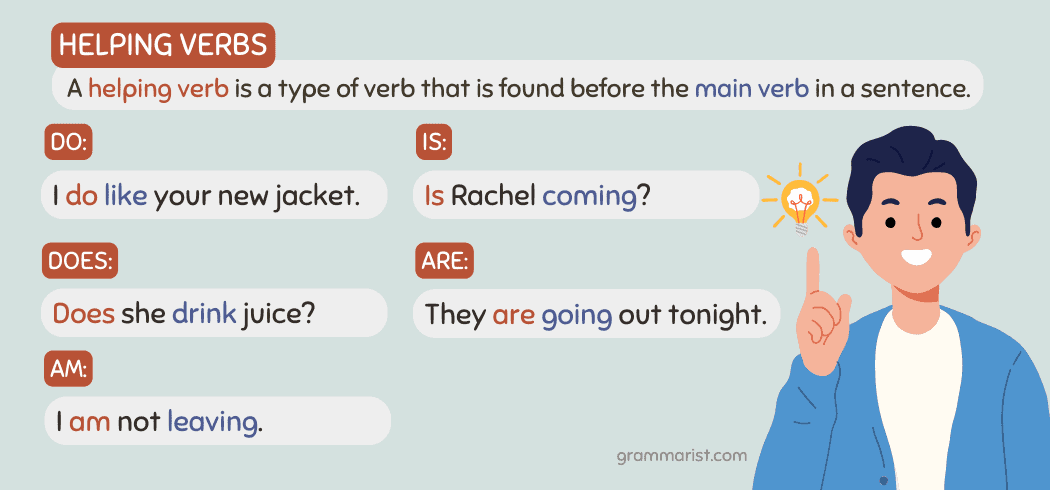

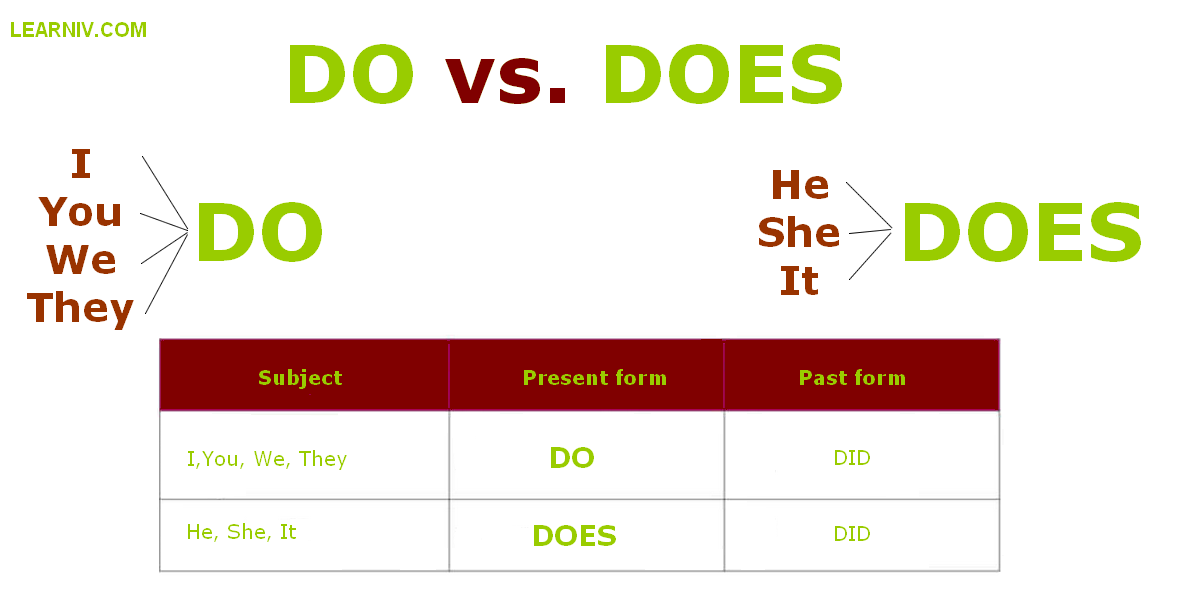

What Does ‘1-2 Business Days’ Mean?

Understanding delivery timelines is crucial for planning. The term ‘1-2 business days’ refers to a time frame that counts only standard working days -typically Monday through Friday, excluding weekends and public holidays [4] . For example, an order placed on Thursday with ‘1-2 business days’ shipping would likely arrive by Friday or Monday, depending on the carrier’s processing cut-off time.

Source: thestockdork.com

Key Details

- Business days do not include Saturdays, Sundays, or federal holidays.

- Order timing matters: Orders placed after the provider’s daily cut-off (often 2-5 p.m. local time) are processed on the next business day.

- Delivery commitments may vary by provider and location, so always check the specifics with your supplier or shipping carrier.

Examples and Application

If you order business cards on a Monday before the cut-off, ‘1-2 business days’ shipping means you could receive them by Tuesday or Wednesday. If you order late Friday, processing may not begin until Monday, making delivery possible by Tuesday or Wednesday of the following week.

Step-by-Step: Planning Around Business Day Delivery

- Before placing an order, check the supplier’s stated cut-off times and holiday schedules.

- Factor in both processing and shipping time when scheduling critical deliveries.

- If you need materials urgently, contact customer service to confirm the actual delivery date, and consider expedited options if available.

- Always build in buffer time for unexpected delays, especially during peak business seasons.

Troubleshooting and Alternatives

Unexpected delays can occur due to weather, holidays, or high demand. For critical materials, keep a small emergency stock on hand or explore local print shops for same-day turnaround. In some cases, digital alternatives (e.g., digital business cards or virtual credit card numbers) offer instant access and added flexibility.

Key Takeaways

There is no universal answer for how many business credit cards or business cards you should have-each decision should reflect your company’s unique needs and workflow. Understanding delivery timelines like ‘1-2 business days’ helps you plan effectively and avoid unnecessary stress. For all financial and operational decisions, prioritize clarity, ongoing assessment, and adaptability to ensure your business remains agile and professional.